Interested?

Request a call here!

Request a call here!

We live in the information age. Every day we see computers, software, and algorithms automating tasks that were once reserved for the highly educated—are loan officers next? James Wang, a PhD student at the University of Michigan, crunched the numbers and came up with an answer.

Much can be said about the value of personalized service, but when it comes down to it, the decision involves money. Loan officers are an investment. Lenders invest in qualified loan officers because they’re required to analyze a plethora of data and make a judgment about a borrower. Naturally, if there were an automated process that could perform the same job, lenders wouldn’t hesitate to use the cheaper options. Recent technological advances in underwriting software demonstrates a method that looks well beyond credit scores to evaluate the creditworthiness of a borrower—but can they make the same subjective judgments as an experienced loan officer?

According to Wang, loan officers are still “worth their salt.” Wang studied data that spanned 32,000 borrowers over the course of three years, 2010 to 2013. This lender specialized in making large, cash loans to individuals and small businesses. Their loan officers evaluated references, financial statements, credit scores, and employment records to make a decision about each loan candidate. So, the big question: was the job performed by the loan officers more or less valuable than what an algorithm would produce?

According to Wang’s calculations, each loan officer contributed an average of three times his or her salary in profits every year. Keep in mind that this is just an average—the decisions made by loan officers are subjective, and, therefore, some are bound to be incorrect. Several loan officers were unprofitable when compared to Wang’s algorithm, but others were many, many times more profitable.

The nature of technology is progress, so it’s only a matter of time before a newer, better algorithm comes along that will finally replace loan officers, right? Not according to Wang. Because the algorithm is calibrated according to the borrowers’ actual repayment data, the chances of success are somewhat limited. The decisions that lead to one loan officer’s failure are the same that lead to another’s success. If an algorithm could be developed to replace loan officers, a similar one could be used to make all the right picks on the stock market—and that’s not happening anytime soon.

Your National Abstracting Solution with a Local Touch

Accurate. Punctual. One point of contact for local searches nationwide. Punctual Abstract is a SOC 1 Type 1 Certified abstracting firm with millions of abstracts performed since 1993.

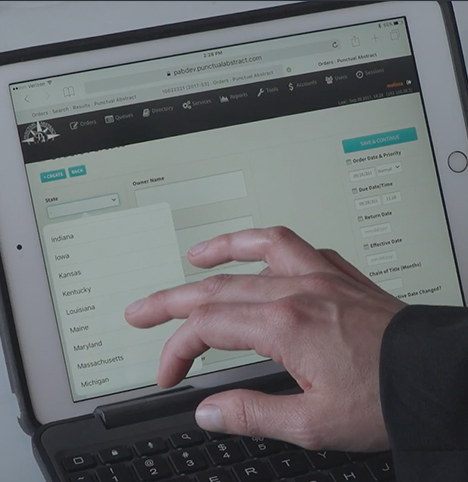

Our proprietary software, Punctual Abstract Base System (PABS), integrates with your title/escrow platform to improve data integrity and SLAs. Projects are generally completed within 24 to 48 hours.

Located in Harvey, LA, we offer boots-on-the-ground and online services for Title Insurance Underwriters, Residential Title Agents, and Foreclosure Law Firms nationwide.

Visit our homepage or contact us today for more information.